Award-winning PDF software

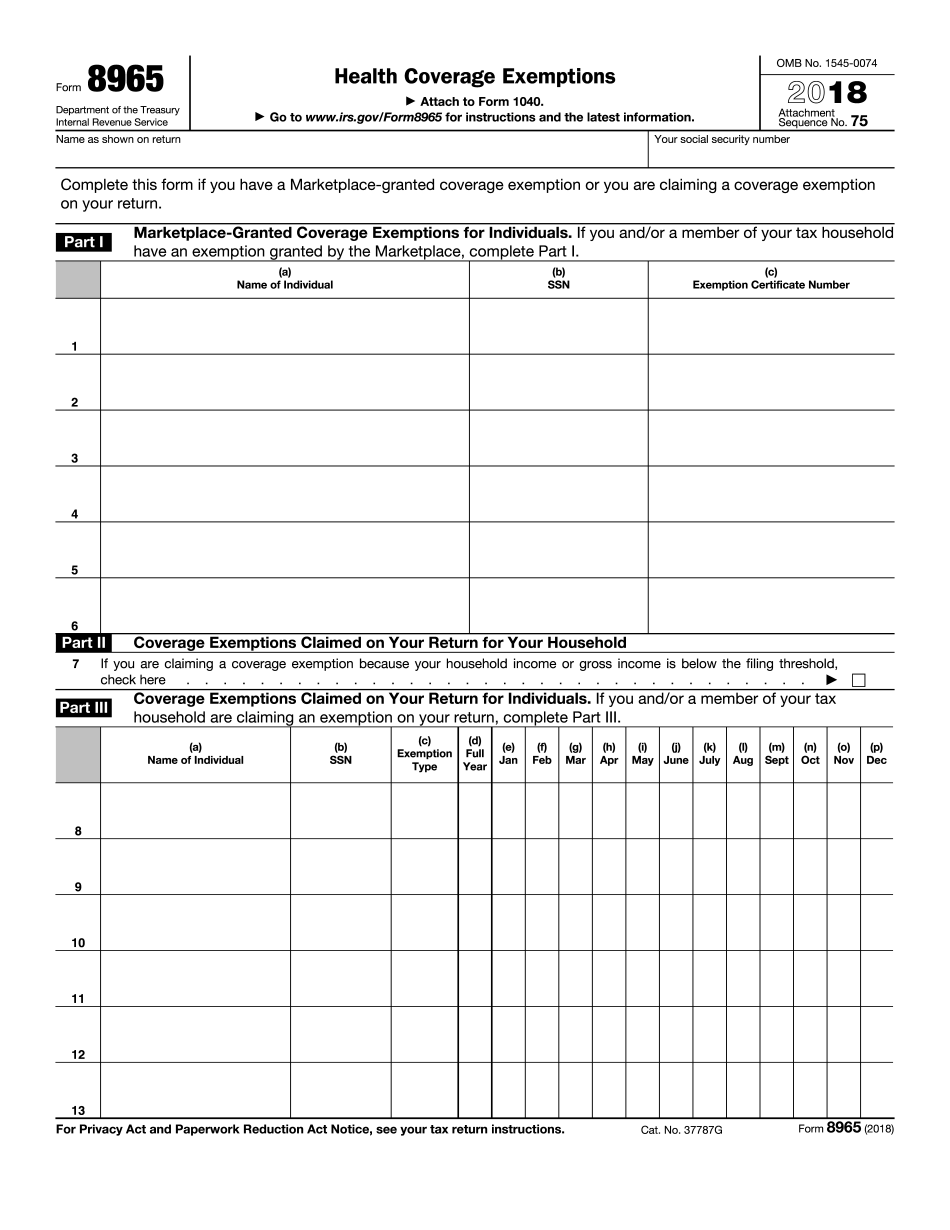

Form 8965 online Oregon: What You Should Know

However, anyone who is not a U.S. citizen, legal resident alien, or eligible nonimmigrant worker may receive an exemption from the penalty if they meet certain requirements . State of Oregon: Exemption from the health insurance mandate: State of Oregon In Oregon: Form 1 — Health Insurance Exemption — Taxpayers Click here to view Form 1-4. If you are eligible for this exemption and file a tax return, you might be entitled to health insurance reimbursement for your medical expenses if your deductible or amount of your creditable costs is more than 100. Your health insurance is not considered to be the coverage of last resort. You must be insured in your Oregon residence, and your out of province medical insurance must meet the following requirements: You have coverage in your Oregon residence that meets all the following requirements: It includes basic group health insurance coverage with group dental coverage for you that is fully adequate to meet your health needs. It includes at least 90% of your total health care expenses (including both out-of-province medical expenses and medical expenses paid by you, your spouse, or dependent children to providers in their own home state). It includes health care coverage at least as comprehensive and affordable as the coverage you had before the enrollment in the group health plan you are applying for. You must continue to have coverage through your Oregon residence that provides you, your spouse, or your dependent child with an eligible health care plan and all the benefits that would have been afforded if you were covered under the group health plan. This is not limited to the amount you have paid for the year in connection with that plan. If your health care plan is no longer valid after it has been in effect for less than 90 days in any year, you must claim an exemption from the health insurance requirement for that year. State of Oregon: Individual Shared Responsibility Provision — Taxpayers The exemption from the penalty for not having health insurance because of immigration status allows eligible Oregonians, and those eligible for the health assistance tax credit through the Oregon Health Authority, to be exempt from the penalty for not having health insurance. Qualifying for an exemption and the health assistance tax credit is the same as qualifying for and being eligible for the Oregon Health Insurance Exemption.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8965 online Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8965 online Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8965 online Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8965 online Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.