Award-winning PDF software

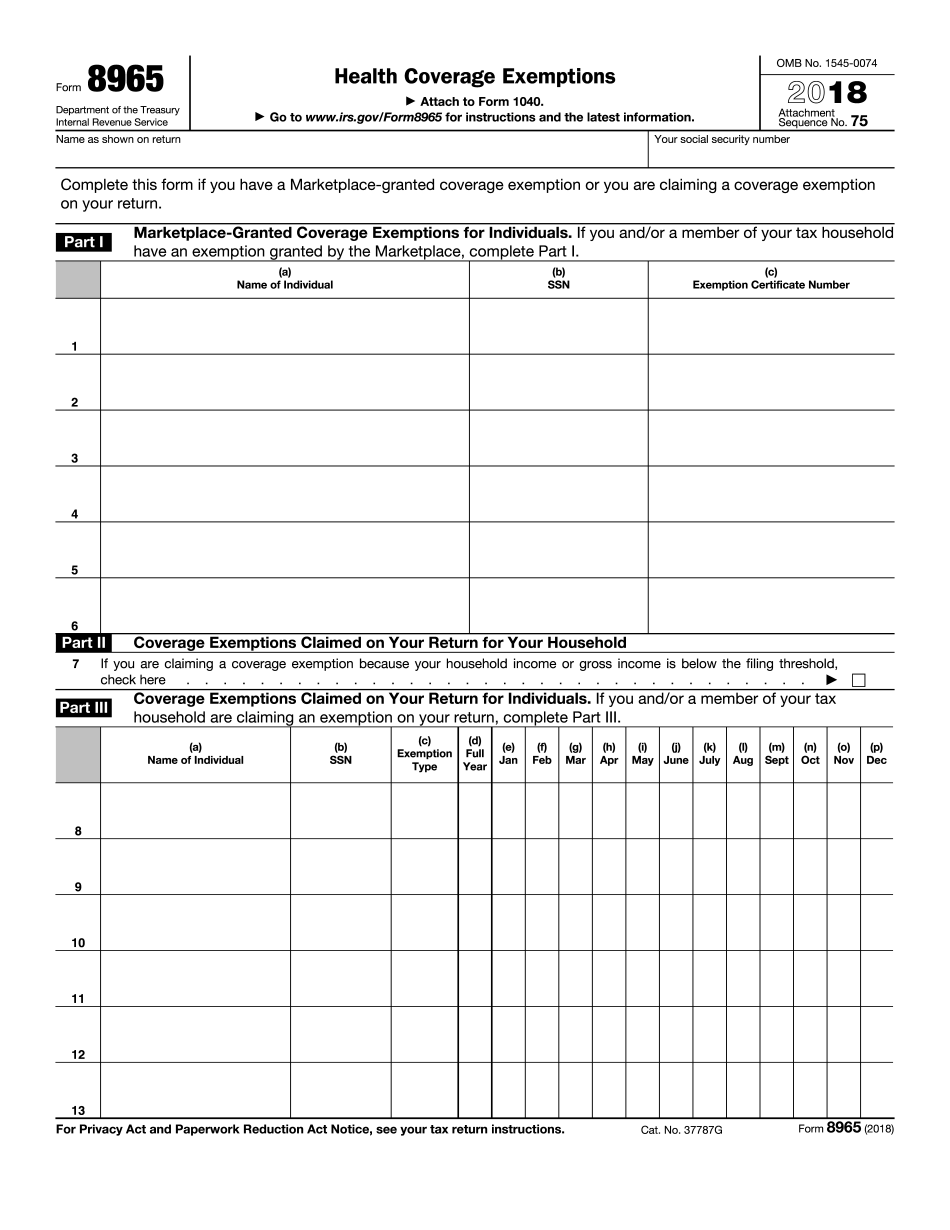

Printable Form 8965 Santa Clarita California: What You Should Know

When is the Notice of Levy on Wages Due? Any time you earn your wages. What if one of My Accounts is in Levy? See: Rialto California Wage Garnishments FAQ's If the IRS levies a wage garnishment that I have not negotiated, what can I do? Negotiate for the lower amount of the wage garnishment; you might be able to get it negotiated down, but that is what you have to try. What if the IRS garnishes my savings? Check out The Federal Credit Union Guide to Wage Garnishments. This document explains the Federal guidelines regarding wage garnishments. Where can I get help? We are your local advocates in California. We are a firm advocating in California as a national law firm in Washington DC. To get in touch to learn more, you can call us at 1.800.662.1234 (English Only) or visit Our Website at our website. Rialto California Wage Garnishments FAQs (Q&A) from the IRS 1) The notice that the IRS sends you is called Form 668-W, Notice of Levy on Wages 2) It is a notice telling you what the IRS is thinking. You can read the letter here: 3) What is the IRS thinking? The IRS does not consider that one is a wage garnishment. You are only considered a debt for the tax year that you owe the taxes/interest etc. (See the IRS Publication 5471) 4) How much does the IRS consider to be a wage garnishment? The tax year of the debt is from the date you file the tax return. So any amount owed will be considered a wage garnishment. 5) What if it was agreed that you would not pay the amount of the wage garnishment? If you and the IRS have agreed that the amount is not due, don't worry. The IRS can collect it. 6) What if I was not aware that the IRS was levying one of my wages to pay the debt? If someone asked is we were interested in paying the debt, we would not be. If we are not paying the debt, then you can not garnish us.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8965 Santa Clarita California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8965 Santa Clarita California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8965 Santa Clarita California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8965 Santa Clarita California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.