Award-winning PDF software

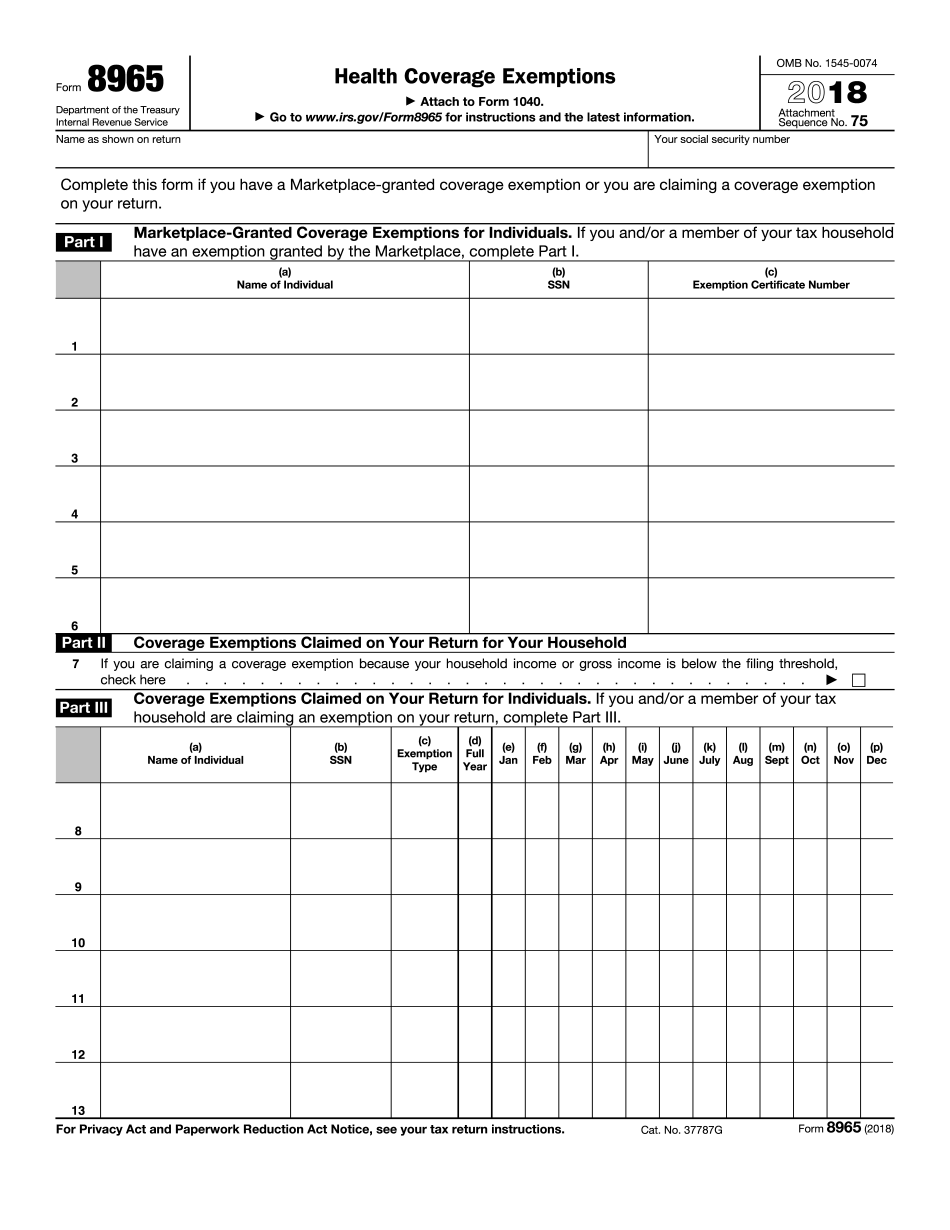

Form 8965 online Chattanooga Tennessee: What You Should Know

Call for more details. Exemption Exemptions for Dependents — Revenue Rulings For 2018, the Secretary will issue the following exemptions: Health plan coverage available to a dependent spouse if: 1. Both spouses are enrolled in a minimum essential coverage plan in the Plan. 2. Each spouse provides an annual income below the applicable threshold (0 – 19,050) during the calendar year in which each spouse files his or her income tax return. 3. At any time during the year, the dependent spouse's adjusted gross income for all tax years prior to the calendar year in which the dependent spouse files his or her income tax return can provide income to satisfy the cost-sharing requirement. 4. An annual limitation (deductible and out-of-pocket limit) for each dependent spouse is used to determine the maximum allowable cost-sharing that each person must pay on behalf of each dependent spouse. 5. A separate premium is required and collected on behalf of each dependent spouse equal to the annual limitation for that dependent. 6. Each dependent spouse is required to pay the premium and pay the cost-sharing on behalf of himself or herself and no tax is withheld on behalf of a dependent spouse. 7. The total of premiums for all the dependent spouses can't exceed the applicable maximum cost-sharing for individual coverage. 8. An aggregate of premiums on behalf is collected. 9. In addition to the premium required to be paid by each dependent spouse, the Secretary may require a separate premium payment for each dependent spouse. This process is referred to as a “deduction-for-deduction”. 10. An individual who meets the requirements above can be considered a qualified individual (QI). Exemption Exemptions for Qualified Income and Certain Exemptions For 2018, the Secretary will issue the following exemptions: Individuals can be exempt from paying any part of the monthly premium or out-of-pocket cost-sharing for certain Marketplace health plans provided that the individuals meet all the following requirements: 1. An individual must obtain a qualified health plan through the Marketplace or another entity. Any health plan offered through the Marketplace must meet minimum essential coverage requirements for the period 2025 through 2026, but may contain certain limited exceptions. 2. The individual must be eligible for federal, state, or local government subsidies to purchase the qualified health plan. The amount of subsidies is set by law. 3.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8965 online Chattanooga Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8965 online Chattanooga Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8965 online Chattanooga Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8965 online Chattanooga Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.