Award-winning PDF software

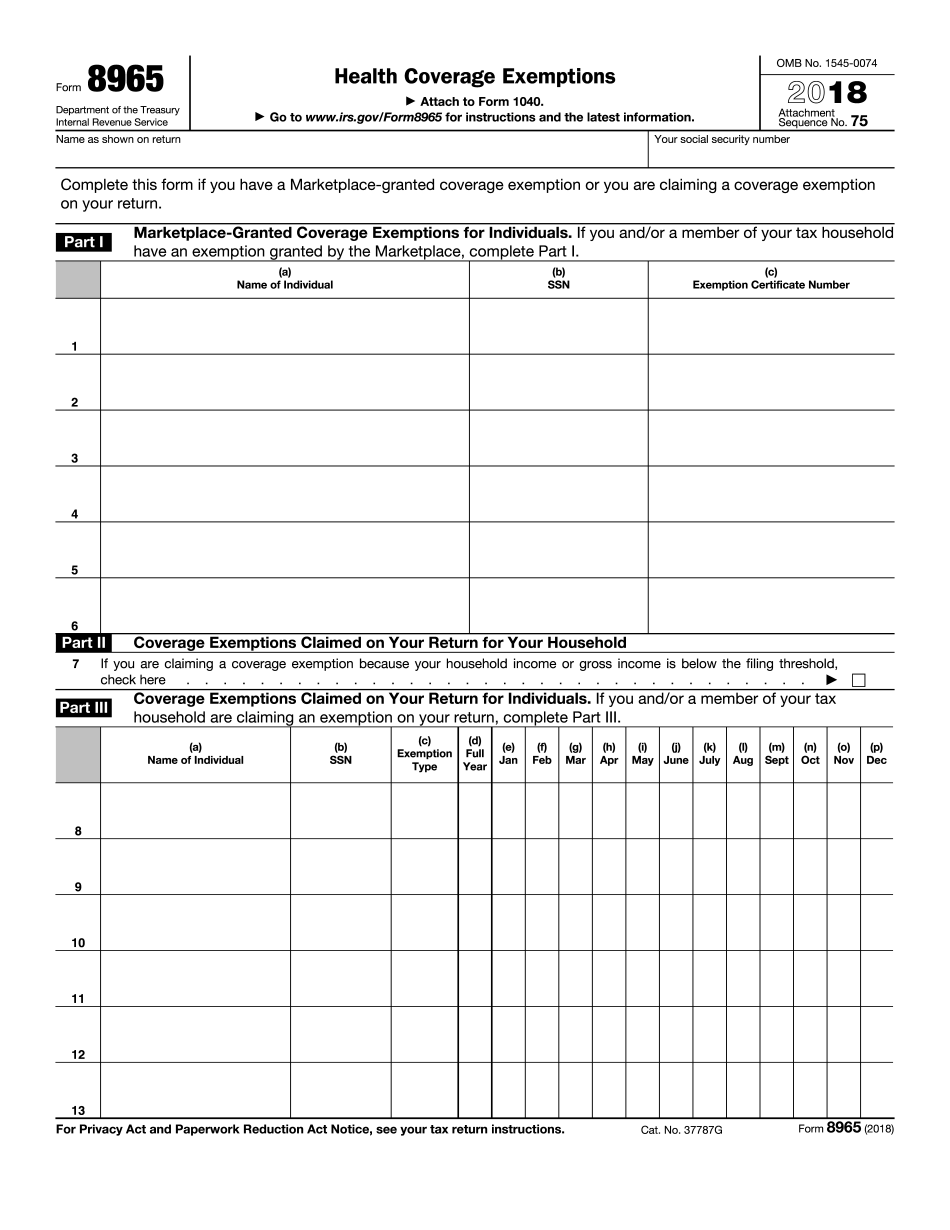

Form 8965 Lakewood Colorado: What You Should Know

If you give a bequest to your beloved spouse before you die, you deduct the actual value of the gift from your estate instead of your estate taxes. ▻ Death of a Spouse. If you are the surviving spouse of a deceased person, you are entitled to receive half of the deceased person's exemption. The exemption amount you are entitled to depend on the total income or total adjusted gross income of your deceased spouse for the tax years during which he or she lived with you. For a living spouse, the standard deduction is not considered to be your separate property. ▻ Disability. You may be able to claim a credit against your estate tax due to the fact that you were required to pay the premium for your employer's health care insurance. In addition, the U.S. Tax Court has ruled that a spouse or other dependent of a disabled individual qualifies for reduced estate taxes if he or she dies before you become ineligible for the benefit. ▻ Disability for Sickness Compensation. If you are a disabled ex-husband due to your wife's pregnancy and the birth of your child, you could be able to claim a credit against your estate tax due to your wife's illness and expenses for her care. Also, if you die after the birth of your child, your estate will be able to claim the deceased's life insurance premiums to pay for your child's medical expenses. ▻ Death of a Family Member or the Death of a Legally Blind Person. If you are the deceased spouse of a divorced spouse or the parent or child of a legally blind person, you can claim a credit against your estate tax. ▻ Disability. If you are disabled, you can claim a credit against your estate tax. Personal Tax Credits. A spouse and a retired spouse may be able to claim a credit against the estate tax due to disability if the disabled person lived with both of the spouses at some time during the Tax Year at the same residence. This credit may be available to either spouse if the disabled person lived permanently with both spouses at the residence during a part of the year during which each spouse was disabled. If the spouse is not disabled, the credit may be available only to the retired spouse. A retired spouse of a disabled spouse can also claim a credit against the estate tax if the disabled person lived permanently with both of the spouses at the residence during a part of the year during which each spouse was disabled. If the disabled person is not disabled, the credit is available only to the retired spouse.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8965 Lakewood Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8965 Lakewood Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8965 Lakewood Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8965 Lakewood Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.