Award-winning PDF software

Form 8965 for Kansas City Missouri: What You Should Know

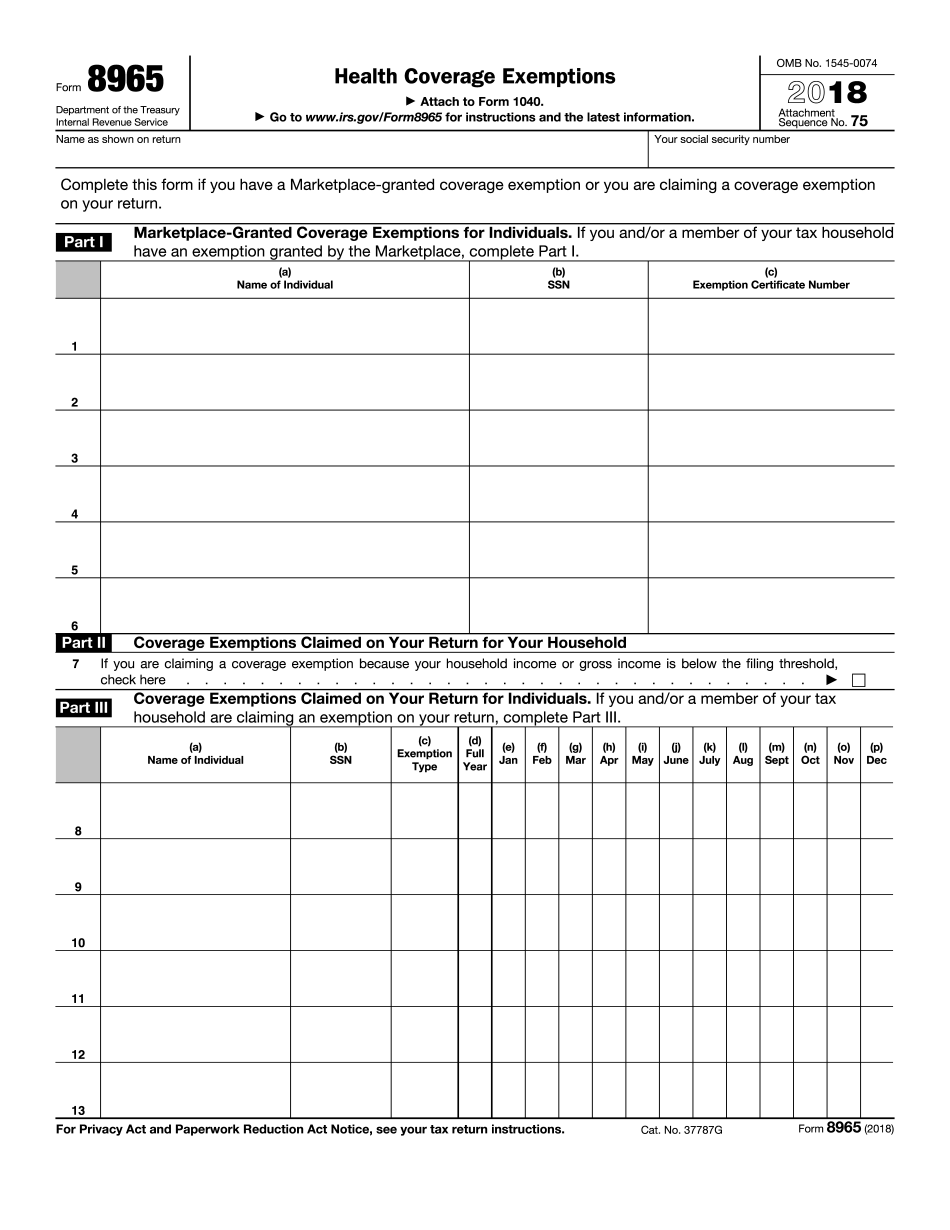

If you do not complete Part I, you will be assigned a failure when submitting your Form 8965. Dec 18, 2025 — Use Form 8965 to report the availability of coverage by Health Coverage Exempt Organizations (sometimes also known as High Premium Tax Credits or Acts) in your city and county 2018 Instructions for Form 8965 — IRS 2018 Form 2915-U — Use Form 8965 to report the availability of coverage by Health Coverage Exempt Organizations (CTO) in your city and county (incomplete Part I but complete Part II). You can access the information you need in Part I by going to or the Marketplace. Please note that the online portal is temporarily not operational. For a time-stamped copy of the information, please do not download an actual paper copy from the Web page because you will not have time to print. 2018 Instructions for Form 8965 — IRS Note: The deadline to report availability of coverage is based on the “Effective Date.” If coverage begins on more than one day, the date of the “Effective Date” is considered to be the start of the day of the coverage begin; and a failure occurs if the “Effective Date” is later than the deadline for reporting availability of coverage on Form 8965. All information on this page is subject to change. If you have any questions regarding this topic, contact the IRS. IRS form 990 is for income tax returns. You need to estimate the income and expenses of the business and report them on the IRS form 990. Form 990-Form 990B is used to report a business. Form 990-Employer Identification Number (EIN) form for the Business If there is some uncertainty in understanding the business activity, go to your local tax authority and inquire to find the EIN and enter it in your documents. Use the IRS number that is available online, but be aware there is a 7 filing fee. Note: The IRS has posted a web page explaining all the Wins with the required tax forms to enter. The IRS has also published a PDF brochure titled EIN (Employer Identification Number) for Businesses. Form 990-G — Employee Tax Statement Employees usually receive Form 990-G and also do not file Forms 1120, 990, or 990-EZ.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8965 for Kansas City Missouri, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8965 for Kansas City Missouri?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8965 for Kansas City Missouri aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8965 for Kansas City Missouri from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.