Award-winning PDF software

Form 8965 Downey California: What You Should Know

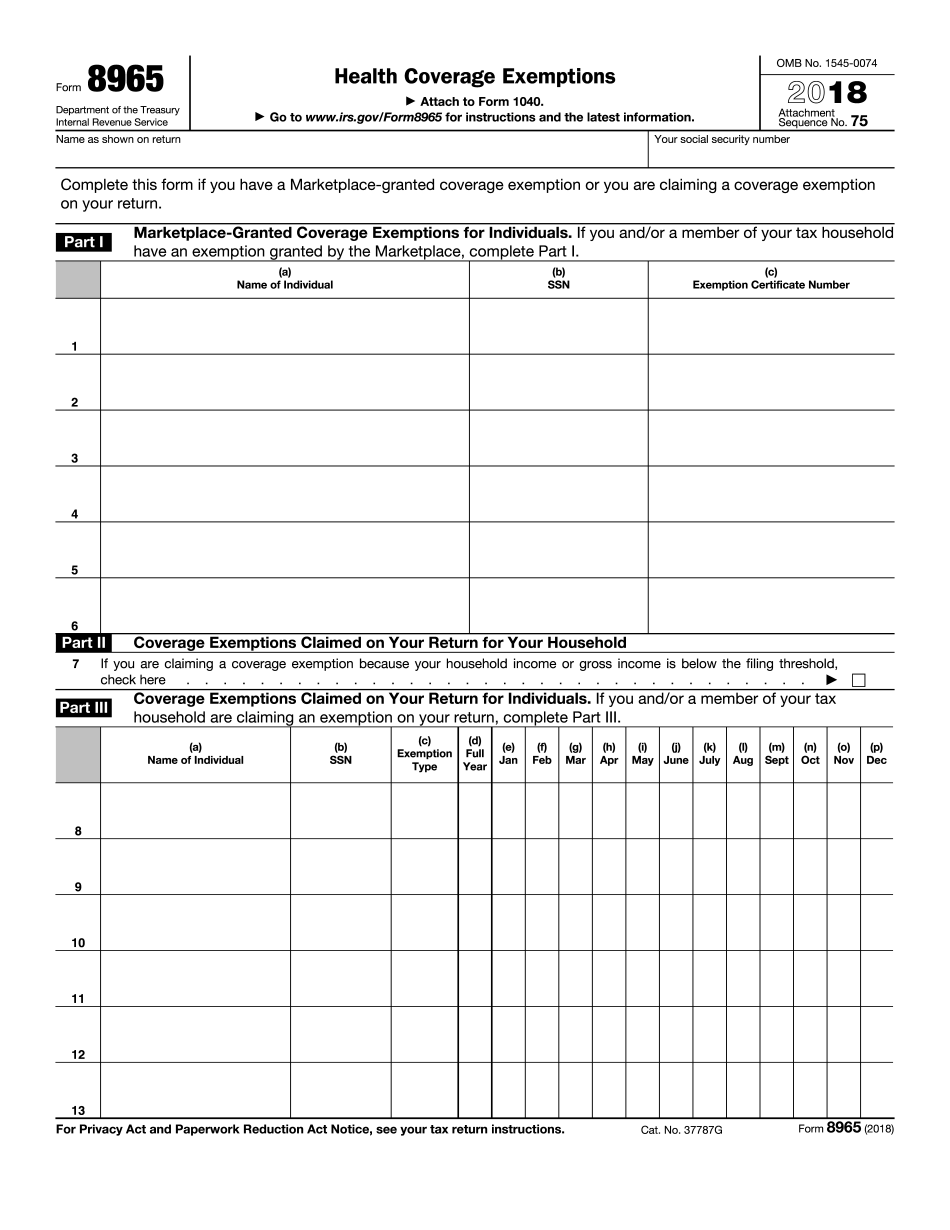

Learn more about the individual mandate, including whether it's actually legal. How to determine whether you have health insurance If you don't have health insurance, you will be fined by the Internal Revenue Service for not doing so. However, if you are an “individual” who doesn't qualify for coverage through an employer, health plan, or Medicare, then you can deduct the full cost of your own health insurance on Schedule A (Form 1040). You may be responsible for paying the penalty if you owe the IRS money because you're not having health insurance. If your household income and filing status are not listed on IRS Form 8965, you can fill out the form if you have health insurance or if you meet all other requirements, including not filing an estimated tax return. Use these links to find coverage: Filling Out the Form Complete a Form 8965 if you've received health insurance. The main benefit is that this form allows you to claim an exemption from the Individual Shared Responsibility Tax—the part of the Affordable Care Act that taxes those without health insurance. If you don't need, don't fill out Form 8965—use the simplified form. To get it: Use the form to calculate you coverage exemption Take the time to figure your coverage exemption for yourself and for your household—you should have an idea if you're covered or if you need to add more members to your household (if you need or want coverage). Your coverage exemption applies only to you. When you report the income of someone else, see How to Report Household Income. Complete the form only if you have health insurance, otherwise you can skip ahead to What Else Do You Have to Do? For instructions on what you should do or have a question. Where To Send the Form If you don't have health insurance, you'll need to send the form you filled out earlier and your tax refund, if any, to the IRS. This could be by e-filing it online, but if you have a paper tax return, you'll need to mail a copy. See How To Send A Return. Don't send the form to the IRS office where your tax return was filed. It does not matter because the IRS has no record keeping records for Form 8965.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8965 Downey California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8965 Downey California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8965 Downey California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8965 Downey California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.