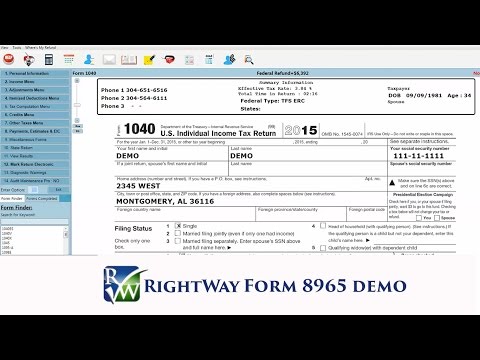

Hello and thank you for joining us for another tax software training video. In this video, we're going to be discussing Form 8965, the Reconciliation of Shared Responsibility Payment. So, we're going to be putting these videos out more frequently in response to common questions that we're getting. This one got us today, and we hadn't really looked too far into it. But once we did, we realized how confusing it can be. So, what is Form 8965? It's basically reconciling your healthcare coverage. If you didn't have healthcare coverage, let's say the parents didn't have coverage but the dependents did, and you don't want to pay for the kids because they had medical coverage or were part of some organization where they were covered. One of the parents wasn't covered, so they're going to get penalized. But we don't need to get penalized for the kids, so we add Form 8965. You can see my shared responsibility payment right here, almost five hundred bucks, and that stinks. But we can also figure out our coverage exemption. So, if you had a scenario where one parent was covered and one parent wasn't, you would go in and see if the parent that wasn't covered had an exemption that may apply. Or, if we want to exempt them from it because they have one of these circumstances, such as being a citizen living abroad or a certain non-citizen, or a resident of a state that did not expand Medicaid. There are a lot of scenarios where this could potentially come into effect. But let's specifically talk about the dependents. So, if we want to get rid of those dependent issues, we would go into the shared responsibility payment and edit the shared responsibility payment of individuals. We're talking specifically about these dependents. Click in here,...

Award-winning PDF software

Irs 8965 instructions Form: What You Should Know

If your 2017 Federal Tax Returns — eSmart Tax If you were required to file a 2025 Federal Tax Return because your eligibility for a Marketplace coverage exemption was denied, or you had to file a Tax year 2025 Federal Tax Return because you had coverage that year, file the 2017 Federal Return Instructions — eSmart Tax 2017 Federal Tax Return Requirements — eSmart Tax Dec 15, 2025 — The Affordable Care Act required individuals and families to use the Marketplace to purchase health insurance coverage for themselves or a dependent, effective for tax years beginning after December 31, 2013. The ACA requires individuals to have coverage through state-based marketplaces or federal marketplace and has provided for automatic enrollment for most eligible individuals in non-group health coverage, including Marketplace coverage. Tax Form 8965 – 2025 — eSmart Tax December 14, 2025 — The federal rules for Marketplace Coverage Exemptions apply to individuals and families. They do not affect state-based marketplaces (known as exchanges), which people use to purchase health insurance of their own and for which they are the sole or main payer. Go to smart Tax for a list and application for Marketplace Exemptions — eSmart Tax F8965—Form 9035—FICA (Employer-sponsored insurance) (FICA) — IRS Nov 8, 2025 — The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2025 amended the Internal Revenue Code to expand unemployment insurance (UI) to employers that offer insurance through an Exchange. The rules, effective for tax years beginning after December 31, 2011, require the Marketplace to notify States and the Internal Revenue Service (IRS) of the number of individuals enrolled in qualified health plan as of March 31 of the prior year. If the Marketplace reports more individuals than of enrolled, the Marketplace can report these individuals for purposes of determining the monthly UI benefit. The IRS issues Forms 1095-A and 1095-A‑S, Employer's Federal Unemployment Tax bill, and Employer's State Unemployment Taxes for taxes withheld from employees' wages, respectively. File the 1095-A if an employer has hired individuals who were also eligible for UI through an Exchange. Make sure to include Form W-2 for each employee, if applicable. The 1095-A is made payable directly to the Commissioner of Internal Revenue.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8965, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8965 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8965 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8965 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 8965 Instructions