Hi, I'm Jeff, a staff accountant with a background in accounting. Today, we're going to talk about how to avoid the shared responsibility payment under the Affordable Care Act. The Patient Protection and Affordable Care Act of 2010, or PPACA, is sometimes referred to as Obamacare. Under this law, medium and large employers must provide their workers with the option to buy health insurance. Additionally, all US citizens and resident aliens, regardless of age, must have health insurance for themselves and their families or pay a penalty called the shared responsibility payment on their federal tax returns. For 2016, the minimum penalty is $695 and is based on the size of your household and total household income. Taxpayers with larger families and higher incomes pay higher penalty amounts. The penalty is capped at two and a half percent of your total asset income over your filing threshold, which is typically between $10,000 and $20,000, or $2,085, whichever one is greater. Total household income includes the income of everyone in your household who is required to file a tax return, even dependents. One way to avoid the penalty is to have minimum essential coverage, meaning health insurance for every member of your household for all 12 months of the year. Minimum essential coverage includes Medicare, VA insurance, Cobra, most forms of state-issued and Medicaid, private insurance purchased on the healthcare marketplace exchange, and employer-provided health insurance. However, supplemental insurance like Aflac doesn't count, as well as standalone dental or vision policies, accident or disability plans, and workers' compensation. The other main way to avoid the penalty involves getting an exemption. There are two types of exemptions: those you apply for through the Department of Health and Human Services at healthcare.gov, and those you apply for through the IRS on your tax return. Common marketplace exemptions include being...

Award-winning PDF software

Shared responsibility payment calculator Form: What You Should Know

Calcutta for the full amount. If you just have your liability to pay estimated, it will tell you what you actually owe and if you made overpayments (i.e. if you were responsible for more than a dollar's worth of claims due to not having coverage). What are the Shared Responsibility Payment Worksheet and Form 8962? — Intuit Form 8962 shows exactly what to do to calculate your payment. It will give you a rough estimate of your payment before you do any paperwork, so you can start calculating as soon as possible. Use it to make sure you are up to date, as your payment will be updated as your financial situation changes. The shared responsibility payment worksheet is part of the Shared Responsibility Payment Worksheet in the ACA Individual Shared Responsibility Provision Calculating workbook. Is the Shared Responsibility Penalties Excluded? — TurboT ax You cannot exclude the Shared Responsibility Payment from your taxes because there is no specific exclusion for penalties imposed in connection with an individual mandate. Where to Send the Shared Responsibility Payment Worksheet and Form 3853: Form 8962 To file your returns without an employer-provided health coverage exemption, use the Shared Responsibility Payment Worksheet and then attach the Form 8962. You should then attach the Form 3853 (if you filed online). The form will be sent directly to the IRS. Send the worksheet and Form 3853 to the: Internal Revenue Service Address: Department of Health and Human Services Payment Amount: Payment Due Date: May 5, 2022, Individual Shared Responsibility Payment Worksheet: Form 8962 For Forms 8962 or 3853, you can e-file on computer. See the instructions for the forms for additional information. The Shared Responsibility Payment Worksheet and Form 8962 are available on this website, in electronic PDF format. You may also download the PDFs directly to your computer. What is the Individual Shared Responsibility Payment (also called the Shared Responsibility Payment or the Shared Responsibility Payment Tax Worksheet/Form)? In the Patient Protection and Affordable Care Act (“Health Care Reform Act”) ( ACA) [Pub. L. No.

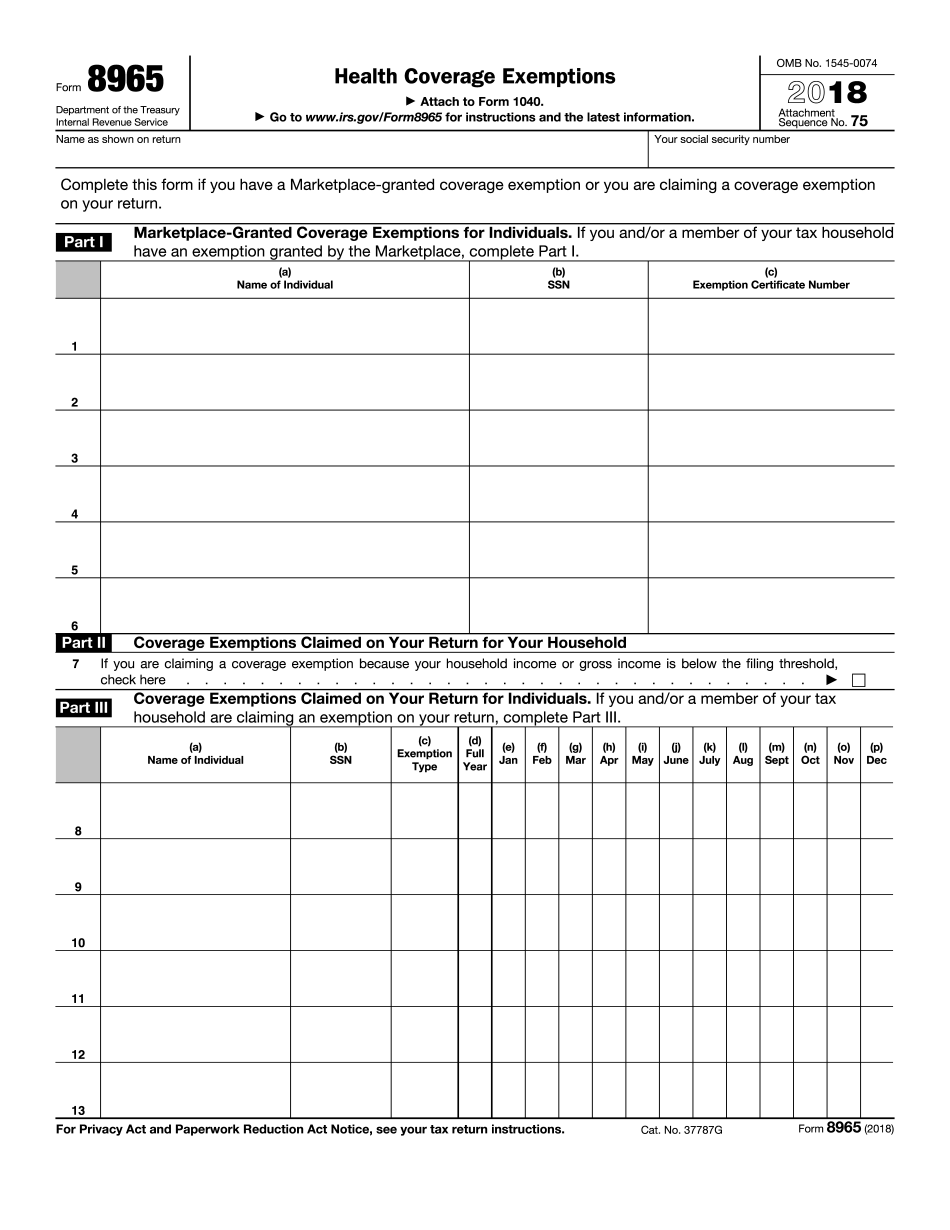

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8965, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8965 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8965 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8965 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Shared responsibility payment calculator