In this tax layer pro training video, we're going to go through a few scenarios involving the Affordable Care Act forms within the software. I've started my client's return and I've entered personal information such as name, social security number, address, and so forth. Now, I'm going to exit the personal information menu. I am asked if I want to enter dependents. I'm going to answer this question with a "no." The software then asks me for my preparer code. I'm going to enter my preparer code. At this point, the program asks me if I had minimum essential health care coverage for myself, my spouse, and anyone I could or did claim as a dependent for every month of 2014. In other words, did my client have health care coverage for himself and his entire family for the whole year? The first scenario we're going to look at is when I answer "yes" to this question. The next question that appears for my client is if he, his spouse, or a dependent enrolled in health insurance through the marketplace or exchange. In this first scenario, I'm going to answer "no." So basically, for this client, I'm finished with the health care part of the return. I answered "yes" to the first question, indicating that my client had full-year minimum essential health care coverage, and "no" to the second question, indicating that my client did not purchase health insurance through the marketplace or exchange. Therefore, we are done with the health care portion of this client's return. Now, let's look at another scenario. In this scenario, we're going to assume that my client had minimum essential health care coverage all year. So, I'm going to answer "yes" to this question. Additionally, my client purchased his health insurance through healthcare.gov, so I'm going...

Award-winning PDF software

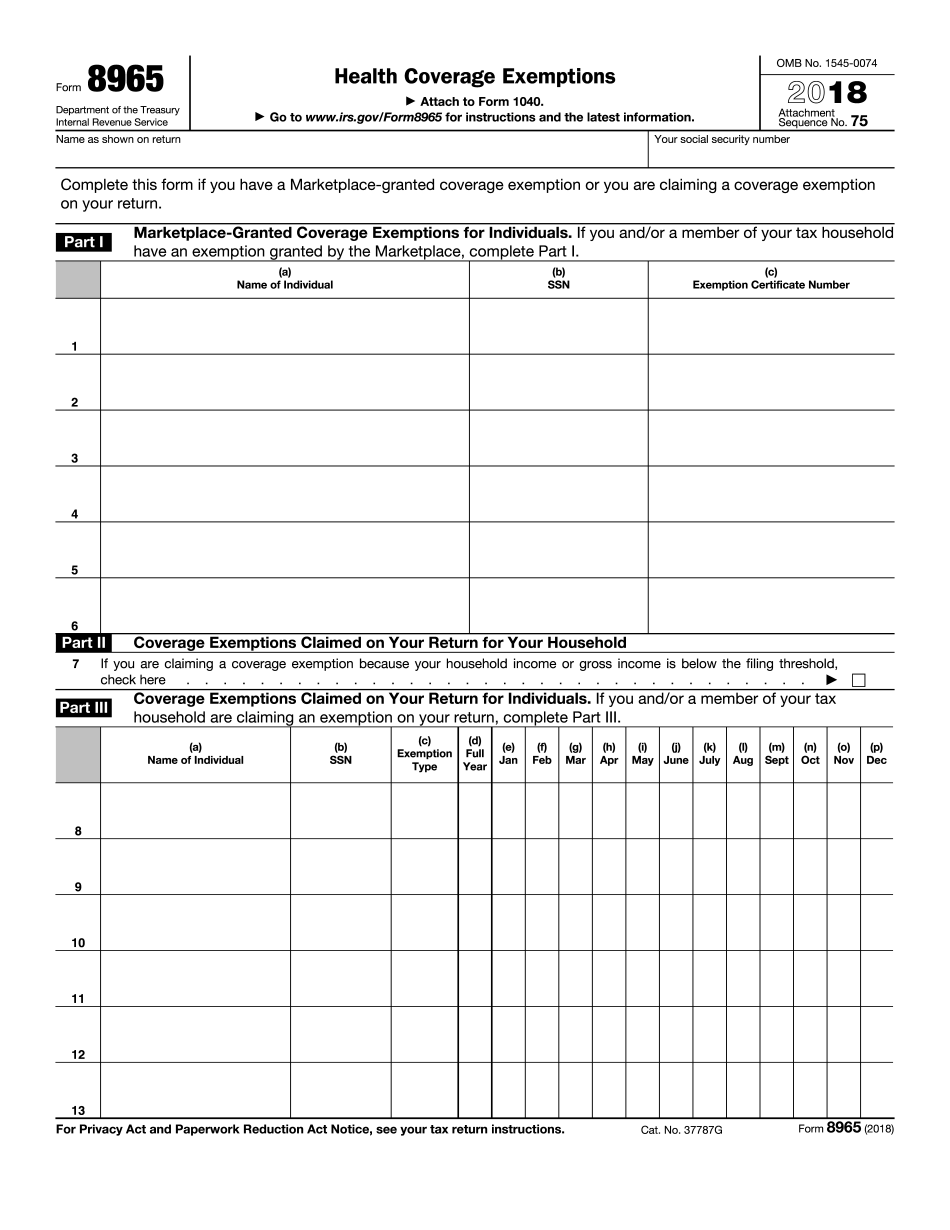

8965 for tax year 2025 Form: What You Should Know

You may be able to use Form 8965 or the file Form 8965 in a few ways: a.) If you didn't have to file a federal form during the Tax Year 2025 or an earlier Tax Year, you can use Form 8965 to claim a health care coverage exemption on your tax return. b.) If you may be a tax filer for the first time, and you need to make a claim of a health care coverage exemption that hasn't been reported on your Form 8965 yet, use the file Form 8965 process, a tool of United We Dream's E-File program and online filing platform United We Dream. c.) If your Social Security or other government retirement benefits are not dependent on your being uninsured, you may be able to use Form 8965 to claim a health care coverage exemption. For example, when you worked for a company that didn't provide health insurance to employees, you could use Form 8965 to claim exemption from paying Social Security and/or Medicare taxes on your taxable income. d.) If you or other members of your family work for or receive a paycheck as an independent contractor, you or they may be able to use Form 8965 to claim a health care coverage exemption. e.) If you or other members of your family have health care coverage that is paid for in full by your employers/employees (for example, a spouse or domestic partner), then you can use Form 8965 to claim a health care coverage exemption. This is the same for members of your household who are dependent on you for income. f.) If you have purchased private health insurance outside the Health Insurance Marketplace, you may use Form 8965 to claim a health care coverage exemption. For more information about using Form 8965 to claim your health care coverage exemption, review the documentation here: Form 8965, Health Coverage Exemptions For more information about the tax filing rules for people who earn under 400% of the Federal Poverty Level (GPL), you can visit the IRS's website. Nov 15, 2025 — Form 8965 is no longer available from the IRS, you are welcome to use the file Form 8965 on the eFile.com platform. For the latest Tax Year 2025 information, download Form 8965-Premium Tax Credit Exemption, here: Form 8965-Premium Tax Credit Exemption, 2025 Instructions, here: Form 8965-Premium Tax Credit Exemption, 2025 filing Instructions.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8965, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8965 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8965 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8965 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8965 for tax year 2025