Hi everyone! Well, now that Obamacare has passed the Supreme Court and you're stuck with it, a lot of you have been asking me what I think of Obamacare. Well, obviously, it's a bill that favors the interests of corporations, namely insurance companies. What it basically amounts to is making people buy health insurance. Some people will benefit from the bill, especially those who are very poor. But mostly, it's going to burden the middle class, forcing them to pay as much as eight percent of their income for health insurance. That's a lot! Your alternative would be to not buy health insurance and pay two percent of your income as a tax for not having health insurance. Likely, the Obamacare bill will also severely limit your health freedom. Here's one worst-case scenario outlined by Mike Adams on Natural News in his article "Obamacare: The Great Swindle". He says that this bill could lead to things like mandatory vaccinations for adults, which is possible because they're going to be making you buy insurance with certain stipulations, which could include requirements for vaccinations. I actually did a video in 2010 about some specific things that are in the bill, called "Obamacare Hidden Goodies". There's lots of stuff in the bill that shows that this is really not just about making healthcare accessible to everyone. It's about having more control over you and limiting your health freedom. If you want to know the facts about how much this is going to cost you, you can go to the Obamacare website where they will talk to you about the cost of Obamacare. They state that the Obamacare healthcare plan will cost the average American around $70. $70? What does that mean? Is it per month, per week, or per what? How is that...

Award-winning PDF software

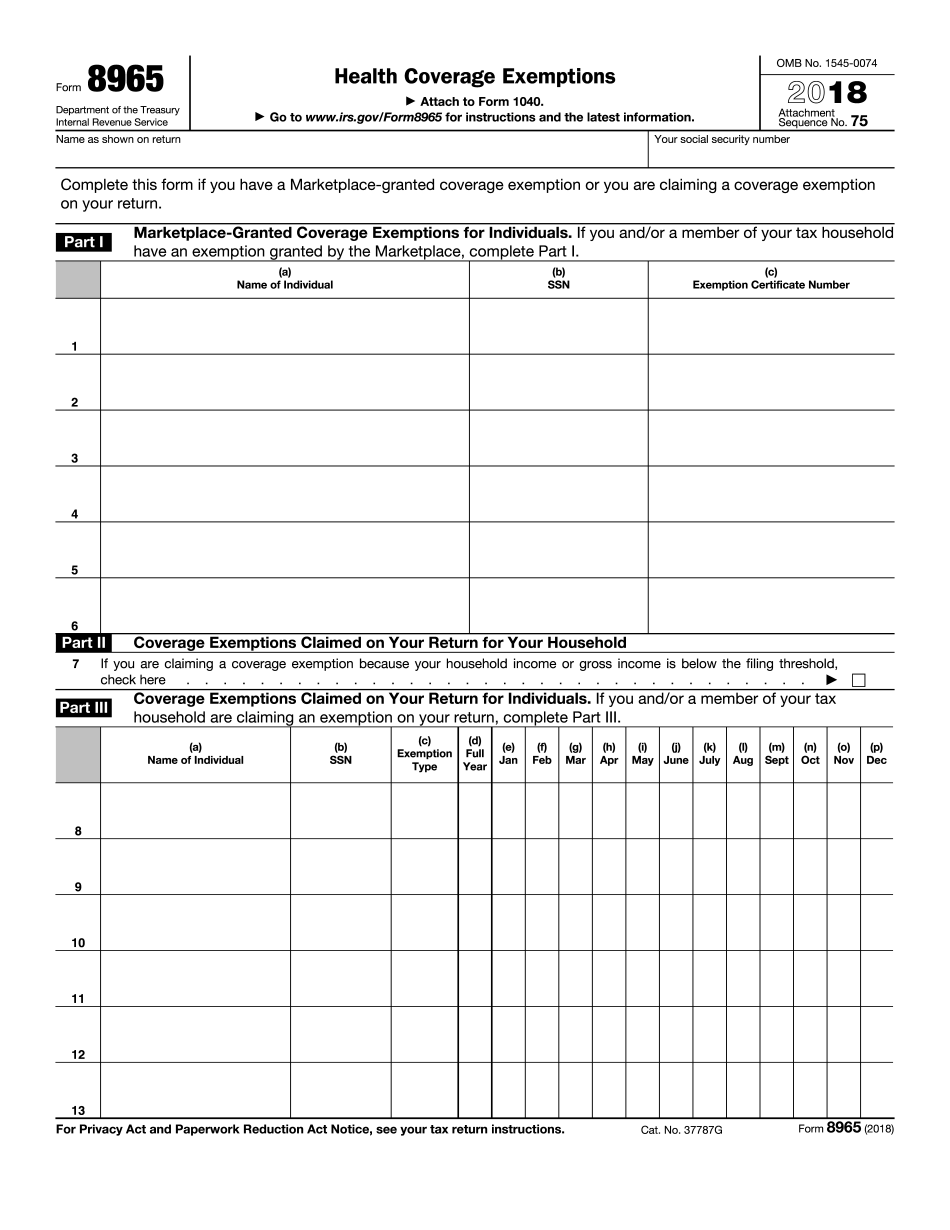

8965 example Form: What You Should Know

Form 8965 (healthcare coverage Exemptions — Individual) — eFile.com When you file your taxes and your return includes Form 8965-Health Coverage Exemptions — Individual, you do not have to pay a tax penalty. Exemptions and taxes: What to know when you do your taxes. American Express offers one credit that may reduce your taxes. You will receive a notification from your bank and if you choose, your credit may not be required to be used in the year(s) to which the credit relates. A Form 8965-health coverage exemption may apply, such as through the Marketplace or your tax preparer, but may not apply to certain expenses (e.g., medical supplies) that were not incurred in the year for which the exemption is claimed. Forms and Instructions You can request Form 8965-Health Coverage Exemptions — Individual at a tax service office. You can also complete and submit this information, if you do not receive a copy from an agent in your tax preparer program. What Are the Benefits of Claiming an Exemption on Schedule A of The Income Tax Return? The tax law exempts taxpayers from the individual mandate of the Affordable Care Act of 2025 for coverage that was obtained through a Marketplace or other tax-compliant source during the Tax Year 2018. That exemption allows you to file a health insurance return on your own, rather than as a dependent of a taxpayer who is required to file a tax return. If you have coverage through a Marketplace, you may be able to get some tax relief, tax experts say. “If you qualify for an exception from the individual mandate, you will need to complete Form 8965 on your own, rather than claim that exception as a dependent exemption,” says Laura J. Ternary, CPA, senior revenue auditor for Americans for Tax Fairness. The IRS will notify you if you are eligible for the tax relief you've requested. If you are eligible, you should receive Form 8965 within 30 days of the date you completed your form, or if you had a Form 1040-C, you will receive Form 8965 within 30 days of your return was filed, with its associated supporting documentation. The IRS will also notify your health care provider of your receipt of Form 8965. What Are the Benefits of Claiming an Exemption on Schedule C Of The Income Tax Return? The law exempts taxpayers for coverage obtained through a Marketplace, but only that coverage which you got through the Marketplace.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8965, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8965 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8965 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8965 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8965 example